Instead of the Sunday morning news shows…

Look at these cool charts & my take on Build Back Better…

The US has room to raise taxes and still remain competitive with peers…

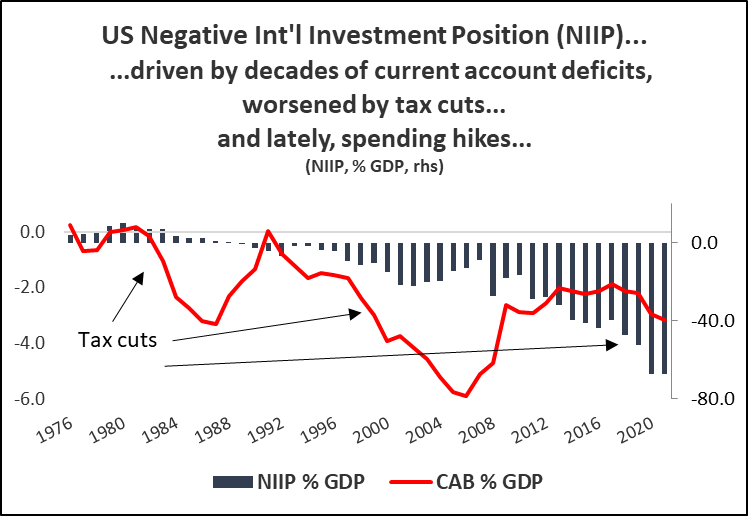

Build Back Better. I start this discussion with taxes because public finances in the US are not well-managed. This is in part due to a history of excessive tax cutting (see chart on taxes and the international investment position at the end of this post).

So, mobilizing revenues has to be the starting point. Then, we can decide what portion of these revenues should go to programs that support sustainable and equitable economic growth — as laid out in Build Back Better — and what portion should be directed toward reducing the government deficit and setting debt on a downward path.

Build Back Better goes in the opposite — and more common — direction: from proposing spending plans to finding revenues to fund them.

As the chart above shows, the US revenue intake is below the median of AAA-rated countries (Fitch), and well below Germany’s and France’s levels.

Raise taxes. Not to the level in France and Germany. The US should not sacrifice its low-tax status, which helps underpin the country’s favorable business climate. The total tax intake could increase from 30% of GDP to, say, 35% and still remain around the levels prevailing in low-tax countries, such as Australia and Switzerland.

Such a tax hike would raise about ~$1.15 trillion (calculated on 2021 GDP), if done in one fell swoop, which might cause rebellion throughout the land. Hence, increments of 1% spread over a number of years would soften the blow and limit any disruption of economic behavior. A hike of 1% would yield ~$230–250 billion per year in the coming years, which magically is close to what BBB envisions in 2027.

Given that the US economy is under-taxed, my approach is to suggest a reasonable figure for revenue mobilization and then figure out how to use it.

BBB’s tax provisions envision covering ~75% of its spending initiatives. However, BBB’s tax hikes are backloaded, while spending is front-loaded. This creates a problem. A downside scenario is elaborated below in which a government elected in 2024 decides to cut Biden’s revenue hikes in half, even as much of the spending is already out the door.

US debt is at historic highs, though still below UK crisis levels…

Cut deficits. The IMF forecasts US budget deficits of 4–5% of GDP later this decade. Build Back Better only increases spending modestly, by 2–4% of GDP, to an overall level of government spending of of 38–40% of GDP. This is not excessive. It’s still below government spending in Canada of 42% and in Germany of 46% of GDP.

The problem in the US is that the government manages its finances like that extravagant neighbor in every town who buys fancy cars and pools and monster home additions on credit. (This fictional hyperbole is designed to make a point.) This notorious neighbor has debt and very little financial cushion in the form of savings in the bank against the occurrence of an unfavorable life event, such as losing one’s job.

The US as a country lives beyond its means, just like this neighbor. As noted above, US government revenues total only 30% of GDP — vs. Canada’s 42% and Germany’s 47%. So, Canada spends more than the US, but runs a budget nearly in balance; and Germany runs a budget surplus.

Friends, Germany’s budget surplus is essentially guaranteed by its constitution. Our constitution, by contrast, guarantees guns. Go figure.

US deficits later this decade seem small compared to the deficits of ~15% of GDP the country ran during the pandemic. But, given that US government debt rose ~25% of GDP in 2020, to its highest level in history, surpassing the debt burden caused by WWII, cutting deficits in half by 2031 seems to me to be good policy. Eliminating them completely would be even better.

Furthermore, the US requires a fiscal buffer against shocks in the future. The non-partisan CBO forecasts federal spending to rise sharply in the two decades to 2050, due in part to population aging and the consequent increases in Social Security and health care spending.

One positive effect on debt dynamics this year was the inflation surprise and strong real GDP growth, which flattered the debt-to-GDP ratio. Can’t count on that again though. Can only do that once. A jolt of inflation raises nominal GDP and therefore the denominator of the D/GDP ratio. But economic agents won’t be fooled again. They will seek to raise wages and prices and to index everything to inflation. This will increase payments the government has to make, nullifying any benefit to the debt burden from inflation. Indexation, if accompanied by easy monetary policy, is how you get runaway inflation, which can ruin economic growth and impoverish the poor.

Reforms cutting the deficit by 1.5–2% of GDP yield a lower path for debt…

Downside shocks featured in the chart above include: lower than expected revenues from BBB (by half) through 2031, and a “loss of confidence in fiscal policy” scenario beginning in 2023 that causes a spike in interest rates of 1.5% on the debt. As a result, GDP growth slows through 2031. After that, the CBO’s long-run scenario prevails, i.e. higher interest rates and increasing entitlement spending occur through 2051. The Downside scenario causes debt to rise close to levels that prevailed in the UK before it experienced a currency crisis in 1947.

A Reform scenario occurs when the government elected in 2024 responds to the Downside shock by initiating reforms, including by cutting the primary deficit by 1.75% of GDP. This allows the interest rate increase to fall back to 1.2–1.3% beginning in 2025, which supports higher GDP growth than in the Downside scenario.

How does the government achieve this?

Options include levying the carbon tax and the VAT, and increasing the gasoline tax. To counter regressivity, i.e. which hits the poor hardest — the government can deploy income support and tax expenditures for low-income households. BBB is already doing this with its expansion of child tax credits and the EITC.

To offset VAT regressivity, the government could increase food assistance, as the IMF has suggested. The other benefit of imposing such indirect taxes is that they encourage savings, which is woefully low in the US. Robust savings limits borrowing and finances investment, which drives economic growth.

Raising the top marginal personal income tax rate, like BBB calls for, is fine. Closing loopholes for the wealthy, such as passthroughs and carried interest, is also worthwhile. Maybe also having a higher capital gains tax rate on less productive investment, such as real estate, makes sense.

Raising the corporate income tax back up to 25–28%, while still keeping the US tax climate competitive within the OECD, is an option. Ending tax preferences for fossil fuels and subsidies for agriculture would be part of a greening of the US budget.

Areas in BBB where additional savings could be reaped include: focusing child tax credits, the EITC, child, elder and disability care, health care, housing and education initiatives on a lower-income cohort than currently envisioned. Means-testing (that is, focusing spending on the neediest) is critical. Ultimately, substantial fiscal savings could be generated by mean-testing Social Security and Medicare, which is highly controversial. Raising the maximum taxable income for entitlements and the retirement / eligibility age would also control entitlement costs.

Programs for the middle class are fine, folks. But, the US can’t afford them right now. Getting US finances in order is a prerequisite for expanding middle class programs.

I get it. It’s good politics to fund middle class programs, especially looking to the next election. On the other hand, I am suggesting optimal policy options, leaving it to the Mozarts of politics — the Pelosis, the Bidens, and yes, the Romneys and McConnells — to find a way to get there.

In Build Back Better, the Dems have shied away from policies they see as election losers — like taxes on carbon and fuel, and means-testing entitlements. Oh well. Country success suffers.

US debt burden in 2051, with no reforms, could reach levels that triggered a currency crisis in the UK in 1947…

Exorbitant privilege. The US can run a profligate fiscal policy because of its “exorbitant privilege.” The global power of the US dollar — what wonks call the dollar’s “reserve currency” status — is huge.

The dollar is in high demand around the world. It is the de facto global currency. It is involved in nearly 90% of all private sector transactions, and central banks around the world hold ~60% of their foreign exchange reserves in dollars.

So, unlike other countries, the US can borrow like that high-rolling neighbor does in Anytown, USA. It can do so, until it can’t. Reputational sources of power in international relations can deteriorate behind the scenes for years without any apparent consequences, and then evaporate one day, as if instantaneously. This may overstate how rapid a great power’s fall can be; nevertheless, this phenomenon occurred in Britain in the first half of the 20th century.

So, if markets around the world lose confidence in how the US manages its finances, then one day, they will sell dollars for another currency. This could cause a currency crisis, as it did in Britain in the summer of 1947.

Sudden stop. The other reason this could happen sooner is that fickle financial markets could initiate a “sudden stop”, where a government can no longer roll over its debts. This occurred during the Euro Area sovereign debt crisis in 2010–12, when countries in the south, including Italy, had trouble refinancing maturing debt. This caused the European Central Bank (ECB) to step in and say, we will buy every country’s debt… we will do “whatever it takes.”

This is not an imminent problem for the US, as everyone from the People’s Bank of China and the ECB to investors around the world still strongly desire to hold dollars invested in US treasury securities as a safe haven investment. But, is the US vulnerable? One measure of vulnerability is the level of debt maturing per year expressed as a percentage of GDP.

Fitch Ratings reports that the US has the highest level for this metric among its AAA-rated sovereigns. See the chart below.

So, better to build a financial cushion by implementing the Reform scenario. Start by tweaking Build Back Better in the United States Senate in the coming weeks. But be sure to ask Senator Manchin to step out of the way of progress on climate change, an historic planetary priority, given his and his state’s financial interests in coal.

US govt debt has a shorter maturity than peers, making a “loss of confidence” scenario potentially more severe…

Political polarization in America results in sharp swings between subpar economic policies, as the two major parties alternate in power. Each party rushes to get done what they can, quickly, before losing control of a branch of government — instead of thinking hard about what the optimal policies should be.

This was true of the Tax Cuts and Jobs Act of 2017, with its deep tax cuts for the rich, as well as the Democratic initiatives today, from American Rescue to Build Back Better, which should have been smaller and better targeted.

The lack of common ground on optimal policies among America’s political leaders undermines the country’s success.

As part of a Reform scenario, I recommend the US roll out and implement a strategic plan — like I produced with a co-author a year ago and like other countries, such as Singapore and Germany, have. This way, the US government could focus like a laser on the key issues. In terms of spending, strategic planning can contain costs by requiring spending proposals to largely adhere to the strategic plan. Build Back Better would be more focused were it part of a comprehensive US strategic plan.

Happy Thanksgiving!

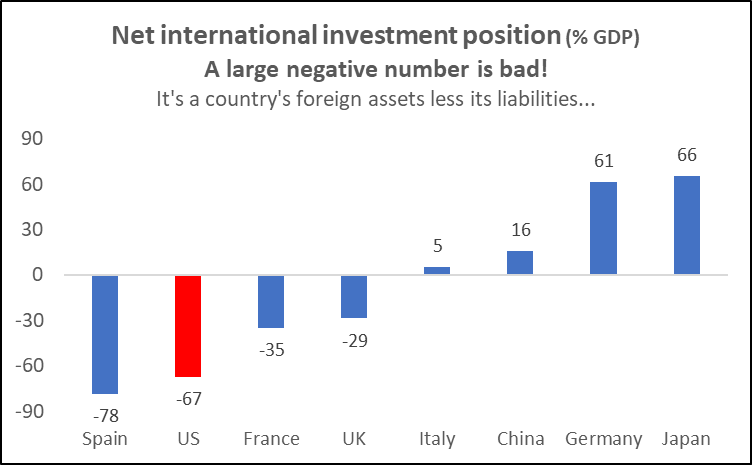

Because US liabilities to foreigners exceed US assets overseas, the US lacks a financial cushion against bad times…